Cash Flows

A MONEY TOOL

ESTIMATE YOUR HOME’S AFFORDABILITY, OR ITS INCOME AS AN INVESTMENT

How to use Cash Flows

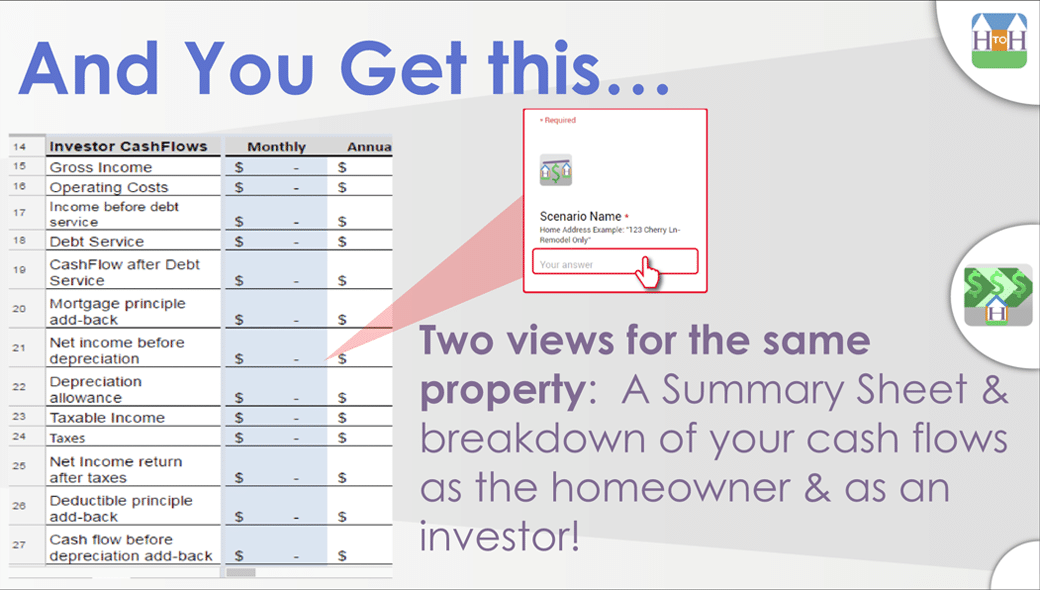

Two views of the same home

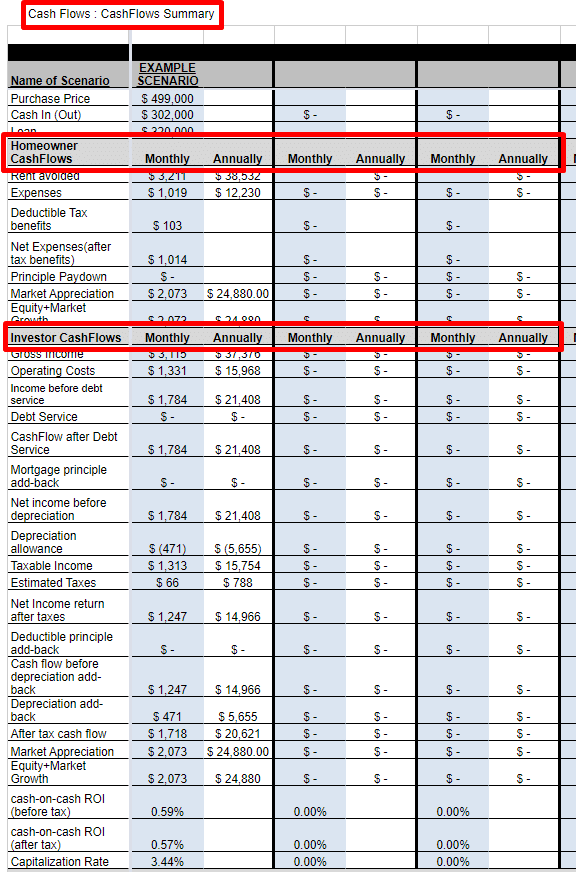

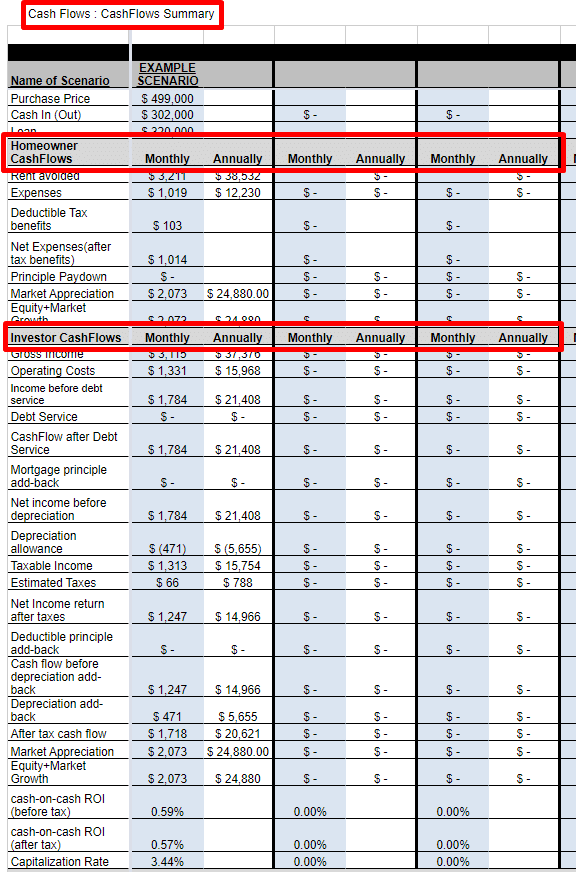

Have you ever wondered if your next home would “pencil as an investment” vs. as your primary residence? Here’s the tool that gives you both views at once.

1. Answer questions in your Cash Flows form

Compare up to 30 scenarios

2. Cash Flows does the work

1. Answer questions in your Cash Flows form

Compare up to 30 scenarios

2. Cash Flows does the work

Cash Flows

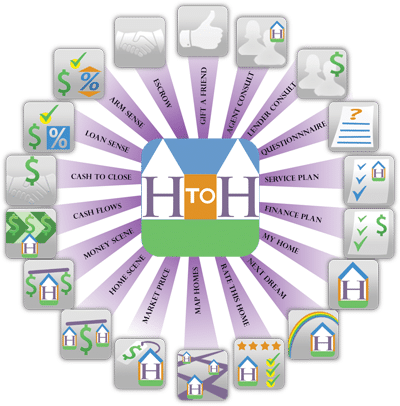

Tools included in Home To Home

Using Cash Flows

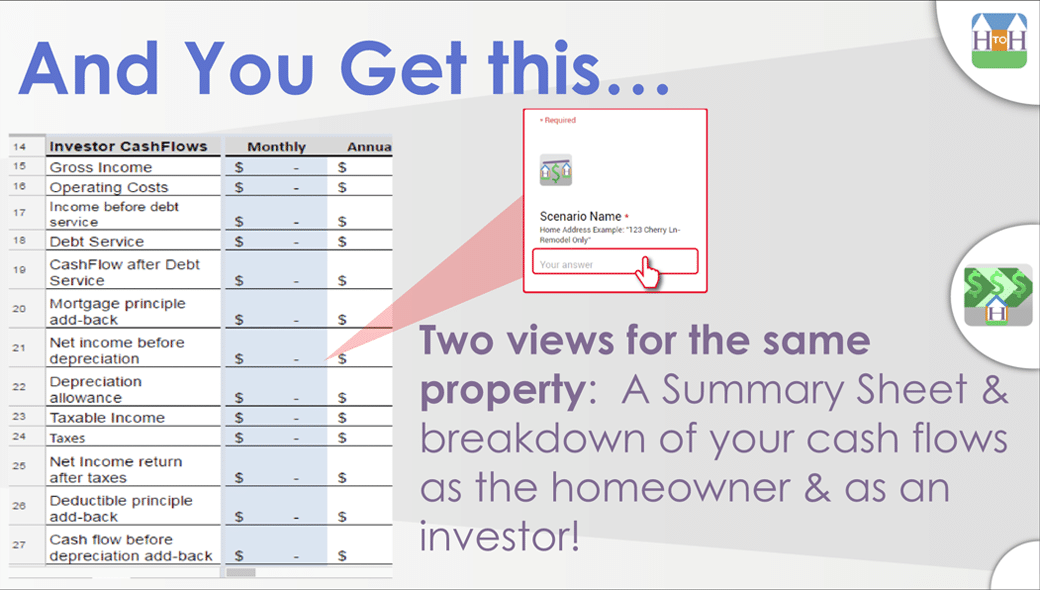

Two views of the same home

Have you ever wondered if your next home would “pencil as an investment” vs. as your primary residence? Here’s the tool that gives you both views at once.

Many foresighted home buyers buy a home and then keep it as a rental after living in it. People love the tax savings and cost of ownership benefits. It’s a great way to build wealth. Cash Flows estimates the monthly out-of-pocket expense AND income as a rental, together!

If you’re currently renting,

Cash Flows can enlighten you as to your affordability prospects. Your monthly outgo looks a lot better when considering tax deductions for example. Cash Flows gives you the side-by-side comparison of these two versions of your living expense.

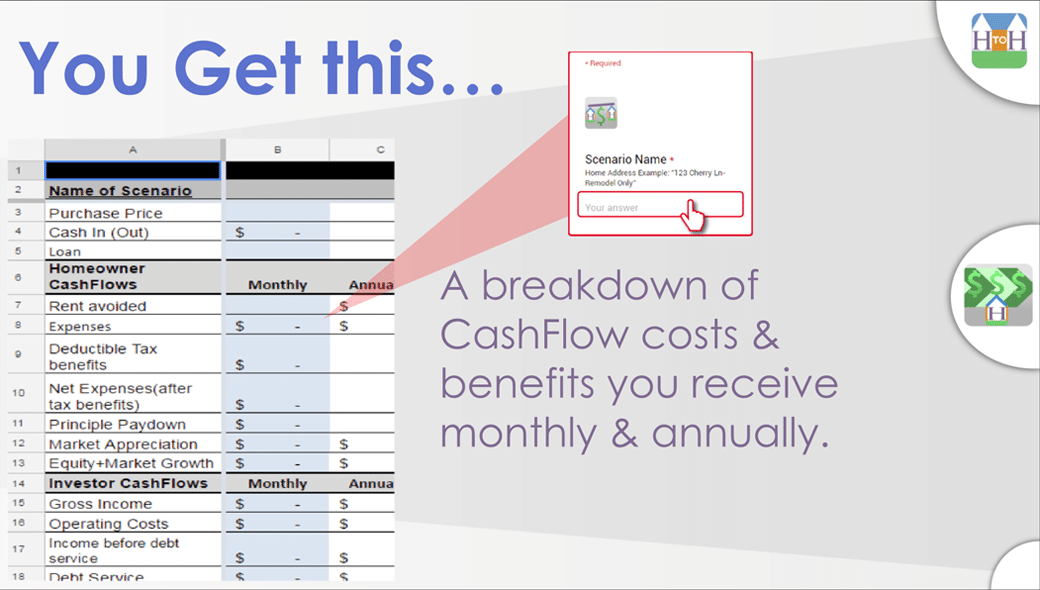

Cash Flows does your heavy lifting- Complex calculations from one simple form.

DISCLAIMER: CashFlows cannot consider all the complexities of the tax codes and your financial situation. Consult a licensed professional before making decisions.

- Whether it’s home ownership or rental property, Cash Flows helps when understanding affordability and profitability.

- Estimate monthly income your home can give you as an investment today and in the future.

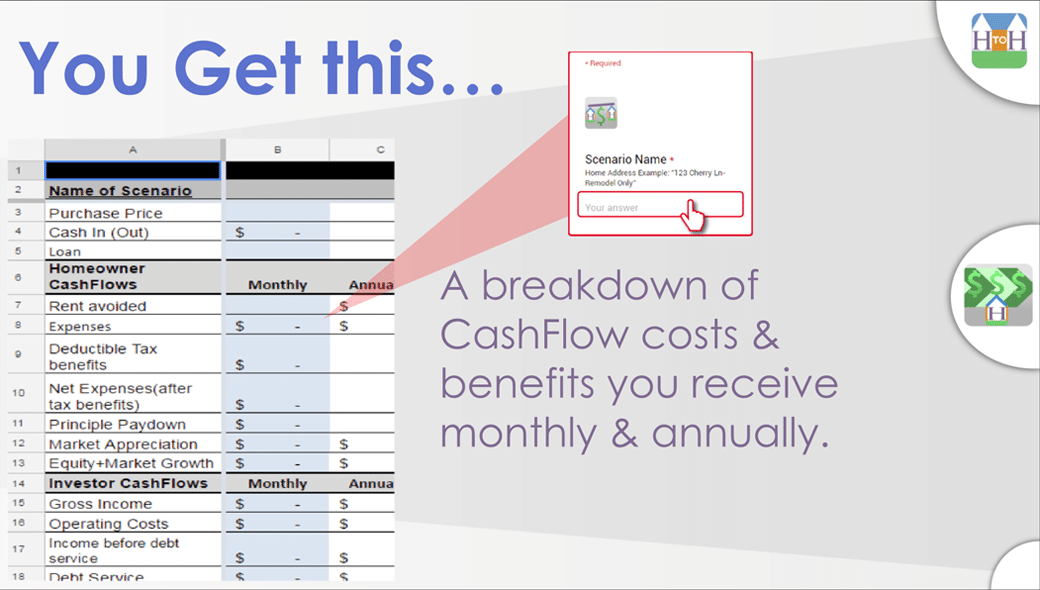

- Summary: A breakdown of Cash Flows costs & benefits you receive monthly & annually.