Loan Sense

A FINANCE TOOL

ALL-PURPOSE LOAN RATING AND FEE DETAILS

Loan Sense

Using Loan Sense

Compare lender financing options

If only it was as simple as an amount and an interest rate. Federally mandated “truth in lending” compliant forms can help but that’s not the whole story.

Loan Sense to the rescue. There’s more to “making a loan”; every case is different. Watch out for fees and costs you may not have expected. Have your Lender add loan programs into Loan Sense so you can discuss and compare.

Tools included in Home To Home

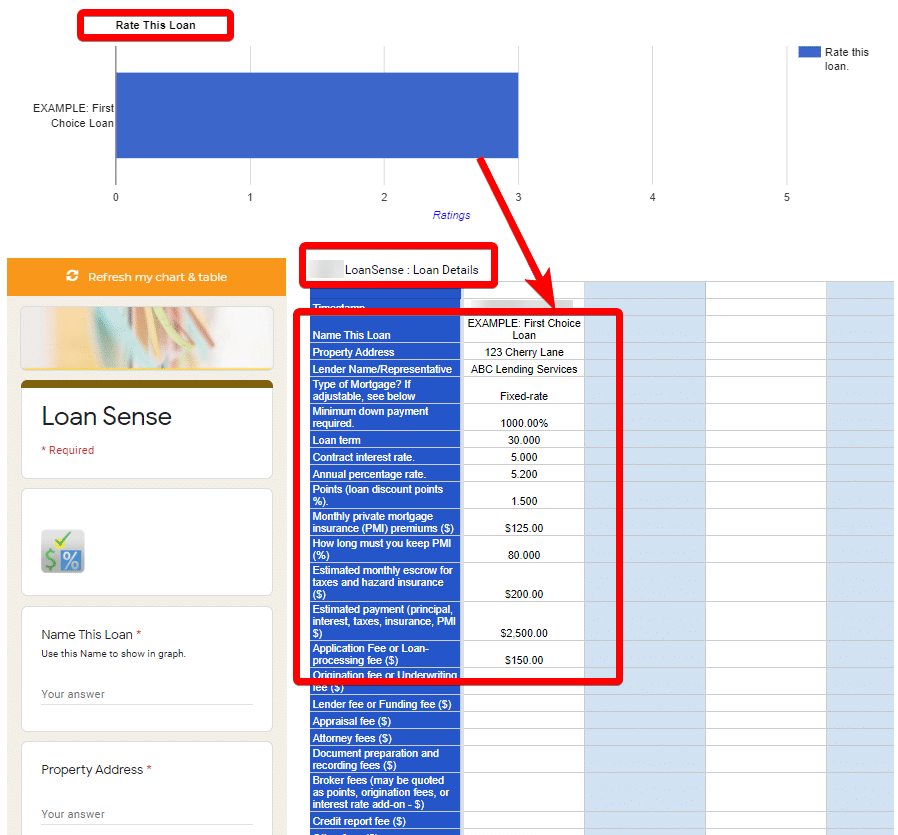

How to use Loan Sense

1. Answer questions in your Loan Sense form

2. Loan Sense presents your results for side-by-side comparison