Cash To Close

A MONEY TOOL

ESTIMATE YOUR CLOSING COSTS FOR BUYING & SELLING

How to use Cash To Close

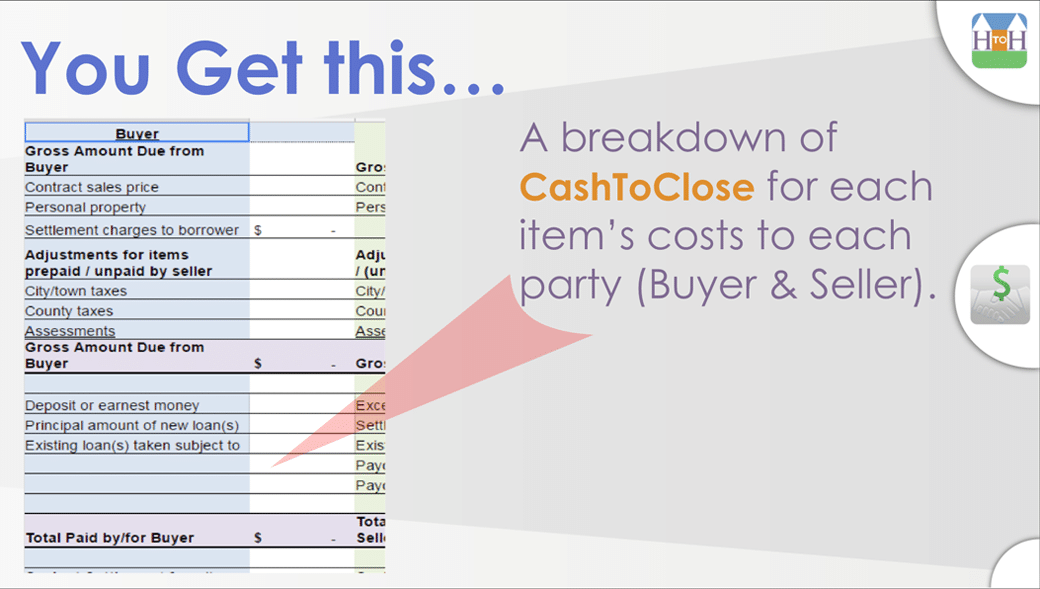

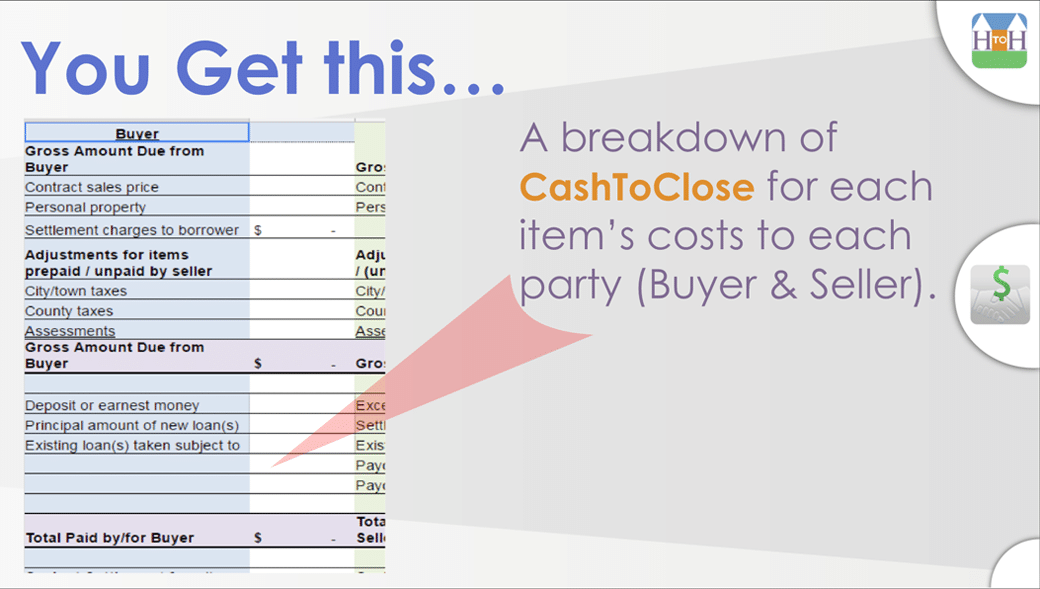

A breakdown of costs to buy and sell a home

Wouldn’t it be great if you had a pretty good estimate of your cash in pocket options before you bought or sold your home?

1. Answer questions in your Cash To Close form

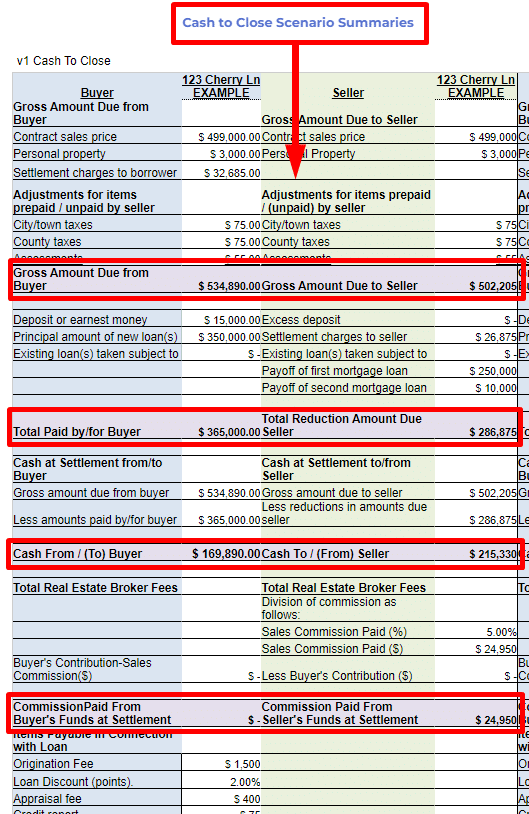

Compare up to 30 scenarios

2. Cash To Close does the work

1. Answer questions in your Cash To Close form

Compare up to 30 scenarios

2. Cash To Close does the work

Cash To Close

Tools included in Home To Home

Identify & compare your transaction closing costs before you enter into one.

One simple form captures and calculates who pays what- your costs and your opponent’s costs.

DISCLAIMER: Cash To Close cannot consider all the complexities of the subject property or your financial situation. Consult a licensed professional before making decisions.

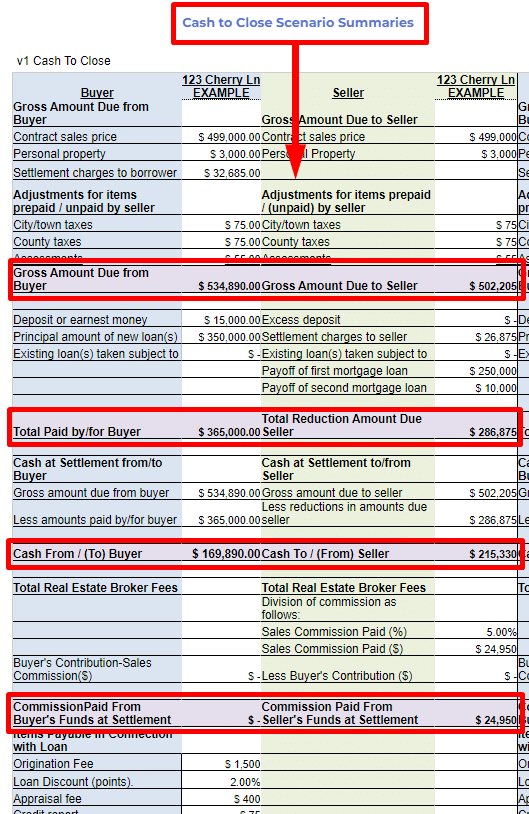

- Explore the scenarios that you’d like to play out. Interest rates, market conditions, purchase terms, and carrying costs impact your decisions.

- Compare the approximate costs of your buy & sell transactions, the financing and cash that you’ll need or receive.

- As a buyer, include your financing costs (Loan Sense, ARM Sense tools).

- Broker’s commissions, title insurance, and escrow charges impact buyer and seller.

- Table: A summary of your scenarios.

When using Cash To Close

A breakdown of costs to buy and sell a home

Wouldn’t it be great if you had a pretty good estimate of your cash in pocket options before you bought or sold your home?

Cash To Close can lend a hand. Home transactions are tallied up using the “closing statement”, a cost breakdown of all costs to buyer and seller, after the transaction is complete.

Compare with the “preliminary closing statement” you’ll receive from Escrow. Use Cash To Close to compare the costs of different options.