Money Scene

A MONEY TOOL

Investor’s Scenarios: Buy a Home, then Sell it

How to use Money Scene

One tool calculates a “flip” – buy then sell

1. Answer questions in your Money Scene form

Compare up to 30 scenarios

2. Money Scene does the work

1. Answer questions in your Money Scene form

Compare up to 30 scenarios

2. Money Scene does the work

Money Scene

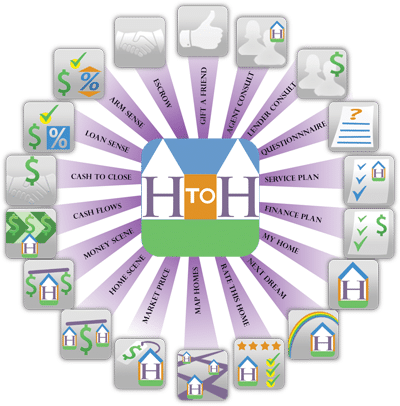

Tools included in Home To Home

Plug in your investing criteria. Money Scene does the complex calculations.

- Explore the scenarios that you’d like to play out. Interest rates, market conditions, purchase terms, repairs and remodeling expenses, and carrying costs impact your decisions.

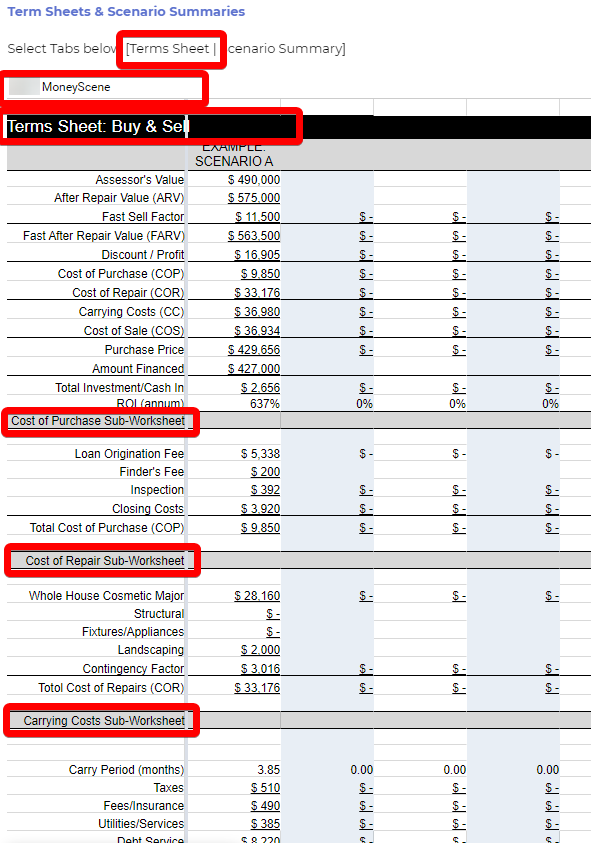

- Compare the approximate costs of your buy & sell transactions, the financing and cash that you’ll need or receive.

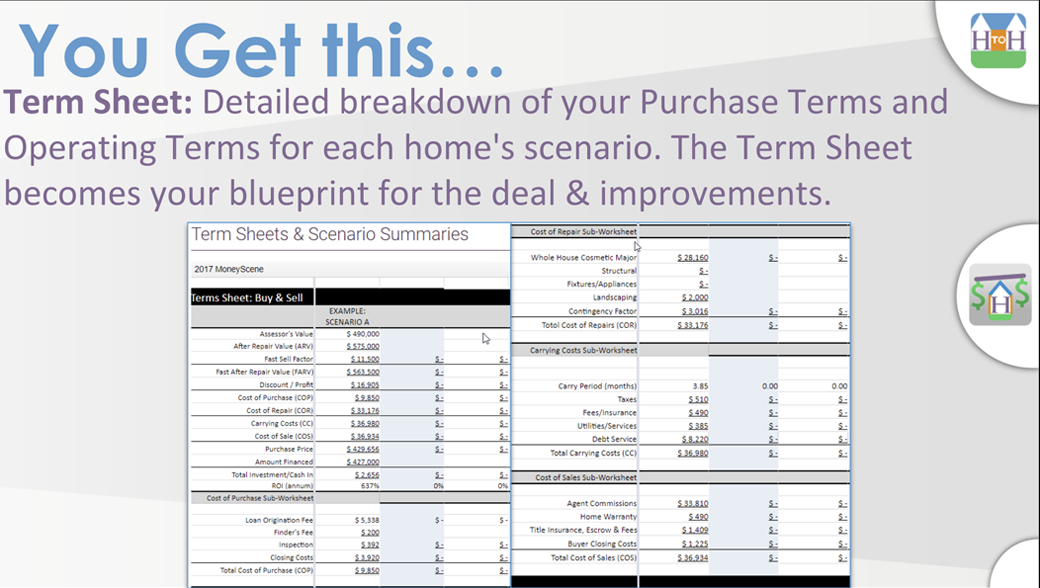

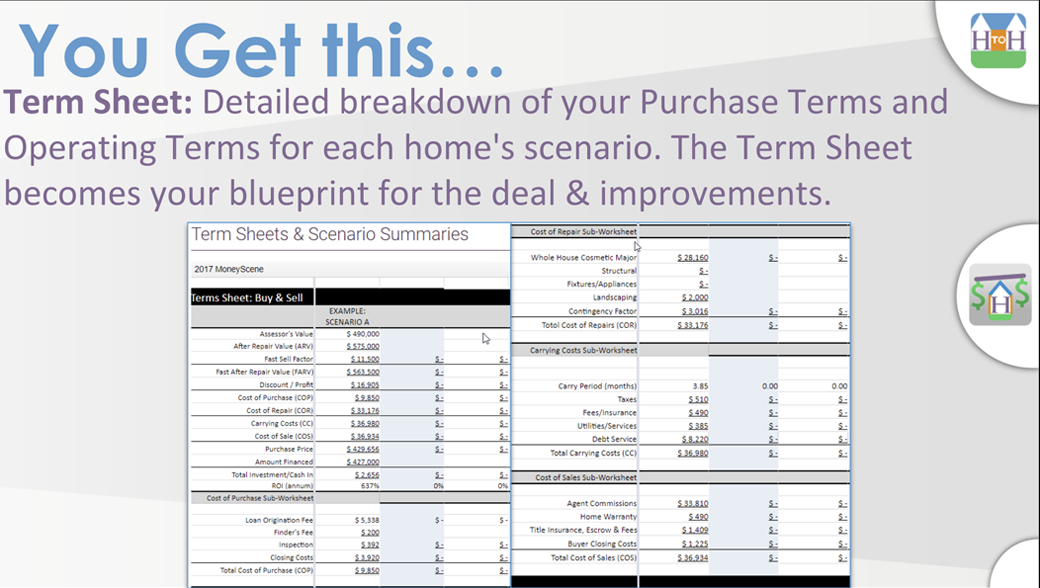

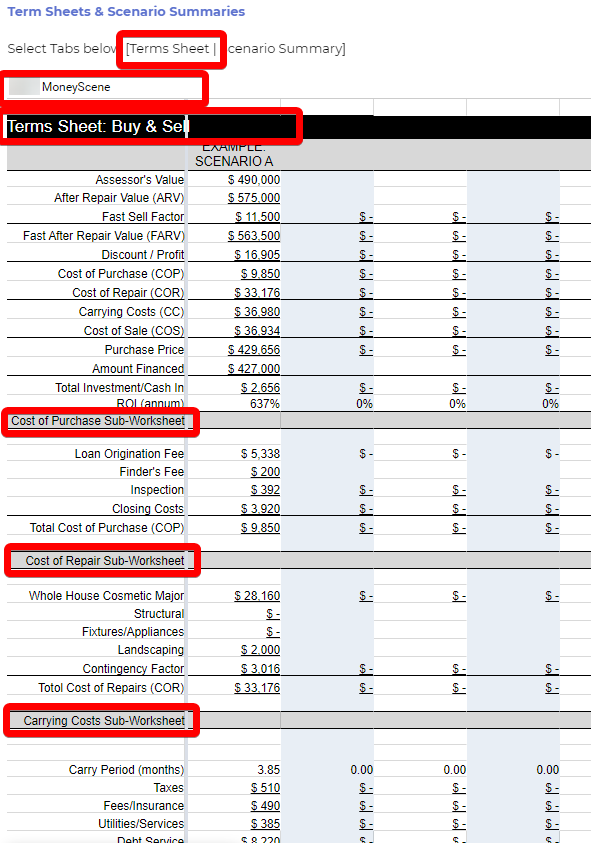

- Term Sheets: Detailed breakdown of your Purchase Terms and Operating Terms for each home’s scenario. The Term Sheet becomes your blueprint for the deal & improvements.

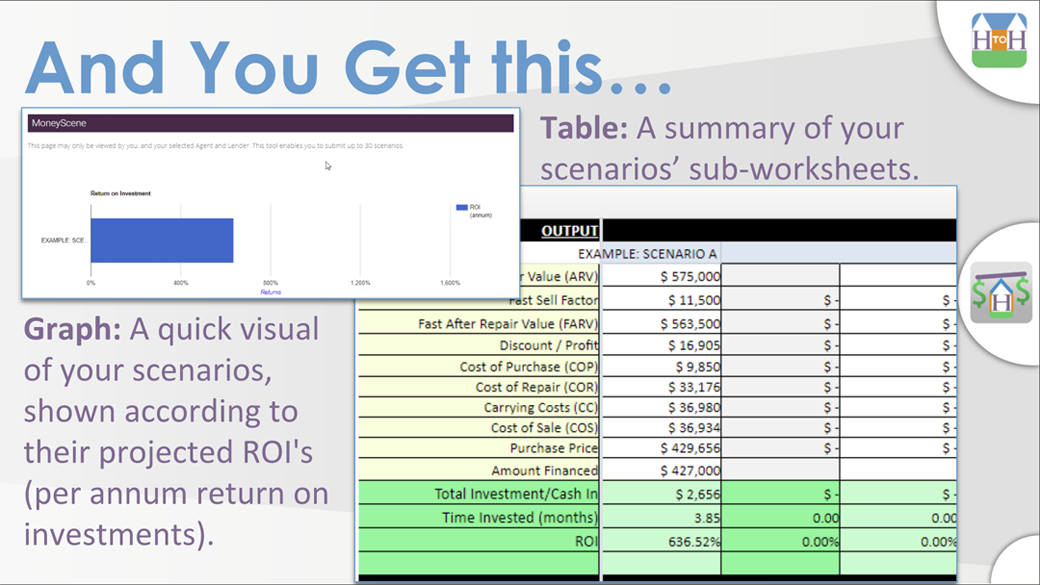

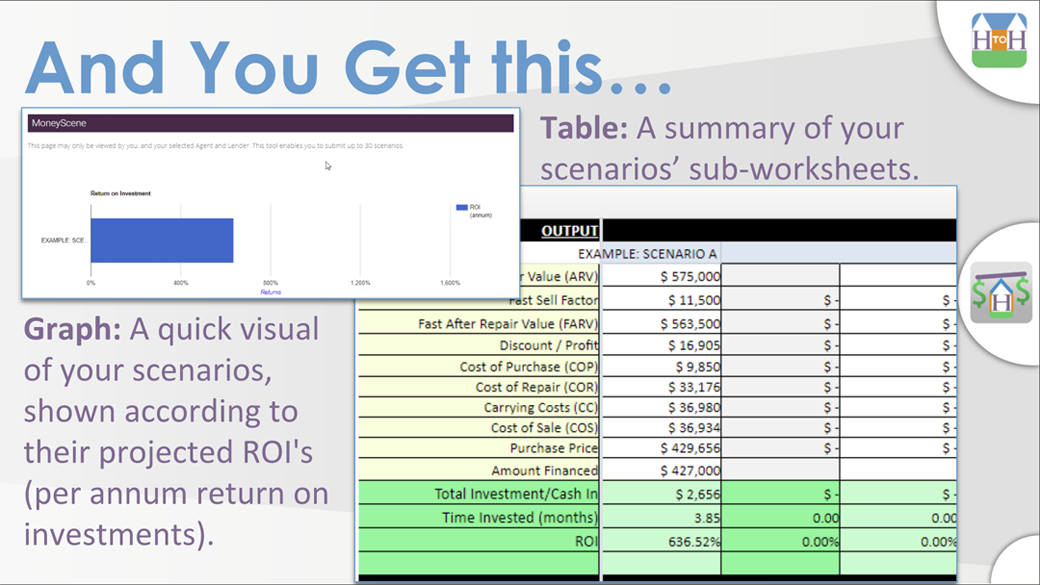

- Scenario Summary: A snapshot of every scenario’s INPUT (from you) and OUTPUT including your key results: Cash In, Time Invested, and ROI (annum).

- Graph: A quick visual of your scenarios, shown according to their projected ROI’s (per annum return on investments).

- Table: A summary of your scenarios’ sub-worksheets.

Optimize your Return on Investment when you “flip” a home

A “flip” is a home that is bought and sold for profit, generally in a short period. Use Money Scene to help qualify homes that you are considering. Examine the scenarios that you’d like to play out.

Money is made by a combination of buying a marketable home at a discount and selling after making judicious improvements.

Money Scene asks you how much profit you are projecting to make. It returns a Purchase Price for you based on all of your inputs. This feature helps you to qualify which homes fit your investment criteria.

MoneyScene will help you to determine your best course of action.