Rate This Home

A HOME TOOL

RATE COMPARABLE HOMES

How to use Rate This Home

Rate each home you consider

1. Rate This Home : input

Compare up to 30 scenarios

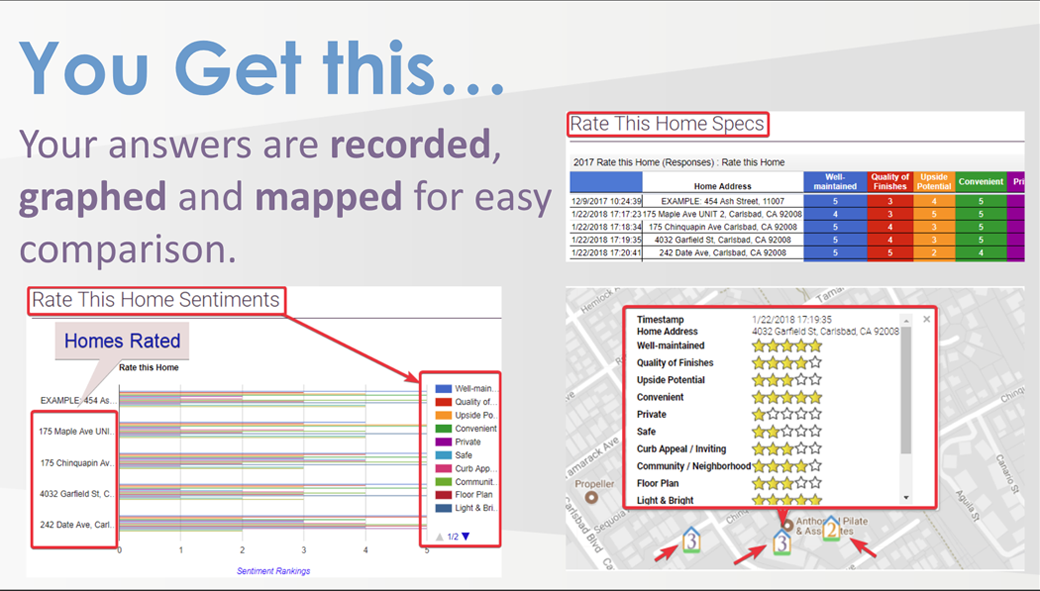

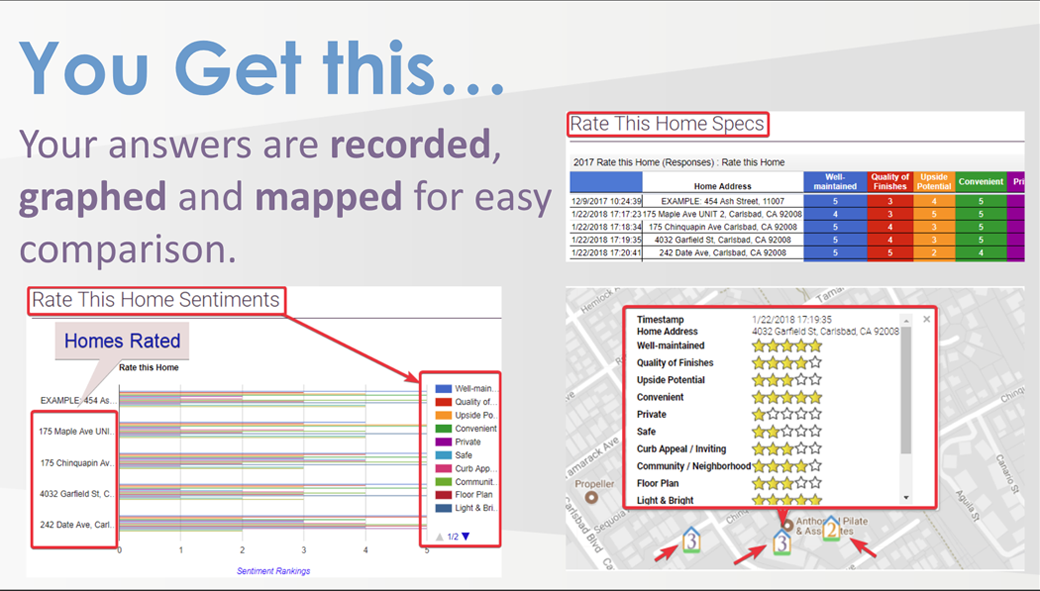

2. Specs & Sentiments : output

1. Rate This Home : input

Compare up to 30 scenarios

2. Specs & Sentiments : output

Rate This Home

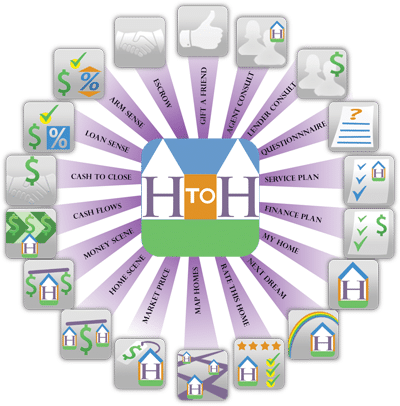

Tools included in Home To Home

Time to Rate This Home

There’s big money in rating homes more accurately

Want a recipe for failure? Look at the pictures online and then put your faith in a computer generated home value as your starting point.

With this recipe du jour, savvier sellers & buyers will clean your clock! Why?

We do not buy our home on specs alone. We also consider sentimental value.

Rate this Home applies a novel rating method we call Specs & Sentiments. The better you can stack rank homes, the more accurately you can align your pricing with the market.

Easy to use. Compare your rated homes:

- on a map (geography & street view)

- in a graph (sentiments),

- in a table (specs)

Benefits of Rate This Home

Whether you’re buying or selling…

- Keep track & more accurately rate prospective homes.

- Use your ranking with your Market Price.

- Each rated home appears in Map Homes to give you another dimension.

- If you’re buying a home: Rate each home to your Next Dream Home.

- If you’re selling a home: Rate competing homes to My Home.